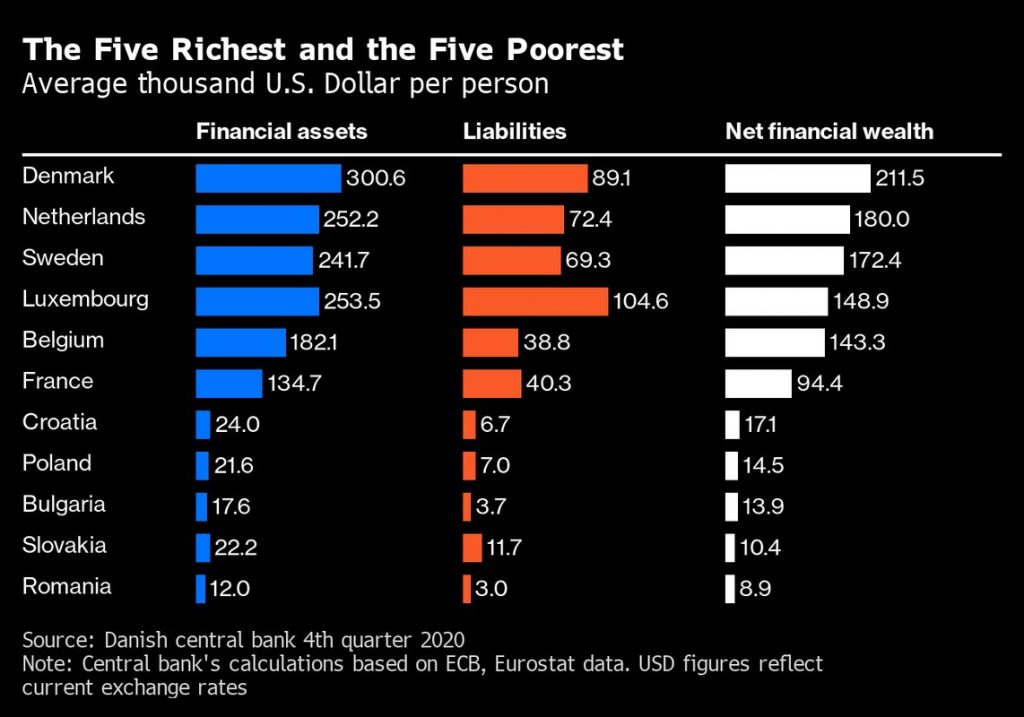

Danish households are the richest in the European Union, according to a data analysis by the country’s central bank.

The average household in Denmark had 1.88 million Danish kroner ($300,000) in financial assets as of the fourth quarter of 2020.

The data, released Wednesday, was extracted from the European Central Bank’s disclosure of financial accounts for the EU’s 27 member states.

The figures showed that Danes typically also had higher debts, at 560,000 Danish kroner, only beaten by Luxembourg, where people typically had 660,000 Danish kroner in liabilities.

However, Danmarks Nationalbank pointed out that the majority of Danes’ liabilities were in bank and mortgage debt “with real estate collateral (approximately 86 percent).”

“Thus, the Danes’ debt is largely offset by the value of housing wealth, which is not included in financial wealth,” the central bank explained.

Overall Danes had a net financial wealth of 1.32 million Danish kroner, nearly three times the EU average of 450,000 Danish kroner.

Denmark’s central bank also stressed that while this wealth was the average, there was a significant difference between individuals.

For instance, the central bank said that Danes with the largest incomes tended to have more assets and liabilities, while people who were older tended to have bigger pensions.

The central bank’s analysis showed Danes’ wealth had grown even more in the first quarter of this year, to an average of 24,000 Danish kroner per person.

Households in the Netherlands had the second-highest amount in financial assets, at 1.58 million Danish kroner, followed by Luxembourg (1.59 million Danish kroner) and Sweden (1.51 Danish krone).

Meanwhile, households in Romania were found to be the poorest in the EU, with just 80,000 Danish kroner in financial assets.

Source: CNBC

Alghadeer TV Alghadeer TV

Alghadeer TV Alghadeer TV